At My Family FI we believe in full financial transparency. The topic of money is taboo for most people and so we want to break down those walls so we can facilitate an honest discussion around money. That's why we're setting the example and putting our money where our mouth is. Below you'll find a breakdown of our most recent net worth followed by a graphical account of how we got to where we are today. It's not always pretty, but each step takes us in the right direction.

Assets: 62,954.99

Liabilities: -251,985.97

Net Worth (w/ Mortgage): -189,030.98

Net Worth (w/o Mortgage): 62,954.99

Change From Previous Month: -140.30

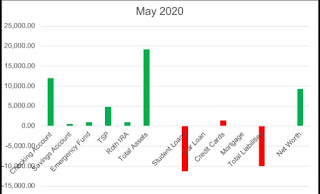

An odd month. Did very well financially. Had a ton of money leftover at the end of the month to put into our different savings buckets (i.e. IRA, 529, emergency fund). But the markets took a hit, so our investments dropped which cancelled out our progress for the month.

Assets: 63,095.29

Liabilities: -252,463.42

Net Worth (w/ Mortgage): -189,368.13

Net Worth (w/o Mortgage): 63,095.29

Change From Previous Month: 5,219.49

Assets: 57,875.83

Liabilities: -252,939.73

Net Worth (w/ Mortgage): -195,063.90

Net Worth (w/o Mortgage): 57,875.83

Change From Previous Month: 5,660.97

Assets: 50,802.14

Liabilities: -254,833.60

Net Worth (w/ Mortgage): -204,031.36

Net Worth (w/o Mortgage): 50,802.14

Change From Previous Month: -4,136.29

Assets: 54,938.43

Liabilities: -255,304.24

Net Worth (w/ Mortgage): -200,365.81

Net Worth (w/o Mortgage): 54,938.43

Change From Previous Month: +1,234.00

Assets: 53,704.43

Liabilities: -255,773.76

Net Worth (w/ Mortgage): -202,069.33

Net Worth (w/o Mortgage): 53,704.43

Change From Previous Month: +2,230.95

Assets: 51,473.48

Liabilities: -256,242.16

Net Worth (w/ Mortgage): -204,768.68

Net Worth (w/o Mortgage): 51473.48

Change From Previous Month: +3,630.43

Well we got pretty lucky this last month (kind of). We were forced to cancel our vacation plans to Asheville, NC due to a change in my work schedule. At the same time, we ended up busting our budget for the first time in a while. It was completely our own fault. We spent a lot of money in our backyard building a 6' long planter box and filling it with soil and various herbs. We bought a small arbor and planted grape vines. We also bought various tomato plants and a couple large decorative pots. Overall we probably spent around $300 last month just on our outdoor projects. It was also an expensive months for birthdays because we have three in April. Add the dogs annual check up and vaccinations, plus six months of flea, tick, heartworm medication and we have a doozy of a month.

So while it's unfortunate that we had to cancel our vacation plans, we were able to take our refunds and cover the extra expenses we incurred with a good portion still leftover that we've put back into savings for the next vacation.

In better news, we broke the $50,000 net worth mark! It took us about 3.5 years to go from a -50K net worth to +50K.

Assets: 47,843.05

Liabilities: -256,709.44

Net Worth (w/ Mortgage): -208,886.39

Net Worth (w/o Mortgage): 47,843.05

Change From Previous Month: +14,309.21

Had a really big month this last month. Firstly, the net worth tracker got a revamp to include home equity and 529 plans. We also used most of the last stimulus check to open up a Vanguard brokerage account to round out the three legged stool of retirement (pension, 401K, social security). Adding a taxable account will provide us with added flexibility during our early years of retirement when we may be too young to pull money from our IRA/401K without penalty. We're also considering to use it in the shorter term as savings for real estate investments (not sure just yet). Also we fully replenished our emergency fund using the stimulus check. All-in-all a big month that increased our net worth by nearly 43%!

Assets: 33,559.39

Liabilities: -257,175.60

Net Worth (w/ Mortgage): -223,616.21

Net Worth (w/o Mortgage): 33,559.39

Change From Previous Month: +4,657.40

We received the federal portion of our tax return which accounts for about $3,000 of our net worth increase. We also spent a significant portion of our vacation savings this last month as we prepare for three weeks worth of vacation this summer. We also just opened a Vanguard brokerage account. The amount is not reflected on this chart yet but it should be up on the next one.

Assets: 28,901.99

Liabilities: -257,640.65

Net Worth (w/ Mortgage): -228,738.66

Net Worth (w/o Mortgage): 28,901.99

Change From Previous Month: +370.31

January always seems to be an expensive month. Due to traveling, eating out, buying birthday gifts, etc., it tends to be an expensive month. We received our second stimulus check and have put most of it into home renovations. We replaced the grout in the entryway, kitchen, half-bath, and laundry room. Then we installed a shower door in the master bathroom. We have about $300 leftover that we're sitting on right now, but it will probably find its way into a savings/brokerage account.

We completed our tax return and should be receiving our refund in a February. We're planning to give the majority of it to my wife's parents to help them pay down the student loans they took out for her bachelors degree. The remainder will likely end up in the same savings/brokerage account as the leftover stimulus check. I'm thinking this is a good time to open up a Vanguard account...

Assets: 28,531.68

Liabilities: -258,184.75

Net Worth (w/ Mortgage): -229,653.07

Net Worth (w/o Mortgage): 28,531.68

Change From Previous Month: +4,888.15

We had a great month to finish off 2020. We paid off the last of our student loans making our only liability our home. Starting this month we'll receive our first of two pay bumps during the year. This will allow us to increase our automatic monthly contributions to our retirement accounts and continue saving money to pay for our next car in cash. Now that the debt is out of the way and we have an emergency fund in place, we can get down to business with some more of the fun things to do with our money.

Assets: 23,643.53

Liabilities: -258,620.75

Net Worth (w/ Mortgage): -234,977.22

Net Worth (w/o Mortgage): 23,643.53

Change From Previous Month: +4,684.94

As of December 2nd, 2020 we are debt free! (Except for our mortgage...) We decided to go ahead and pay them off once and for all. At the start of the forbearance period, about 6 months ago, we decided to save our final lump sum student loan payment to bolster our emergency fund. And in the meantime we continued to build our actual emergency fund until it had reached nearly the same amount that was left on our student loans. We've been fortunate enough during the last 7+ months to have a stable income and the flexibility to choose how we employ our money. The incentive to pay off our student loans changed, prompting us to change our financial plan. Luckily we didn't need to use any of our emergency fund, but had an incident occurred, we were ready.

So, now that the student loans are out of the way, we're on too bigger and better things. The money saved in the next coming months/years will go toward our next used car/college. I have a couple small pay increases over the next 6 months that will go straight into retirement savings. Next month I'll be able to do my annual financial review to see how we did in 2020. I'm sure we'll continue to have minor surprises along the way, but now that we have a substantial emergency fund, we should be able to handle most anything that comes our way.

Last update from this last month. Jessie and I took out additional term life insurance policies to bolster our existing policies. Jessie and I had $100K and $400K policies (respectively) through the military SGLI. We knew for a long time that this was not sufficient, but we dragged our feet on the topic. During the beginning of the month we finally did some shopping, gathered a few quotes, and then pulled the trigger, bringing our policies to an even $1M each. It wasn't difficult to find policies, but I was unaware of the discrimination some companies show against military members. (Discrimination is a strong word, but many companies don't offer policies to active duty military). Now I can sleep comfortably knowing that if Jessie plans and executes my demise, her and the kids will continue to live comfortably.

Assets: 31,808.72

Liabilities: -271,905.88

Net Worth (w/ Mortgage): -240,097.16

Net Worth (w/o Mortgage): 18,958.59

Change From Previous Month: +780.88

This was certainly not a strong month for net worth increases. Some of our net worth increase was offset by our annual start of Christmas shopping, something that we spend the year saving for. This time of year always deflates our net worth performance, though the rest of the year is subsidized through Christmas savings. We also had to purchase tires for the SUV which ran us about $550. Even with that extra expense, we still had nearly $900 leftover at the end of the month.

Next month will be the first with extra traveling expenses as we head home to Ohio for the holiday season. We'll take our usual trips around Thanksgiving and Christmas. As usual, we'll have higher dining out costs as we eat out with family more often than we do on our own. Though this year may be different due to Covid-19 restrictions.

Assets: 31,075.97

Liabilities: -272,388.01

Net Worth (w/ Mortgage): -241,312.04

Net Worth (w/o Mortgage): 18,177.71

Change From Previous Month: +4,171.12

We ended up having a really strong month. It was partly due to my absence for two weeks while I was out in the field playing Army. We did have some unexpected expenses arise (as they always seem to do). The course I'm preparing to start in a week requires a functioning laptop at the house. Unfortunately our previous laptop was barely hanging on. So after some research we found a suitable replacement, making sure we were getting the best deal we could find. This equated to an extra $300 expense for the month. All-in-all though, after all expenses, including retirement contributions, we had an extra $800+ to contribute to our emergency fund.

Looking forward into November, we already know that we'll be fighting with a large purchase. New Tires... Unfortunately the SUV we purchased nearly two years ago has three balding tires. To be fair, we've put about 35,000 miles on the car in that time. Tires and installation will end up running us about $600. The weather is also getting colder and the girls are running out of clothes to grow into (we're finally running out of all those clothes that were given to us from relatives). So another couple hundred will likely be allotted to filling out their wardrobes for the cold season. Regardless of all this, we have our retirement savings covered and a healthy emergency fund, plus enough cash set aside to finish off our student loans once the forbearance finishes up. I guess we'll see in due time.

Assets: 26,322.75

Liabilities: -270,232.62

Net Worth (w/ Mortgage): -245,939.41

Net Worth (w/o Mortgage): 14,006.59

Change From Previous Month: +1,241.80

This last month was unusual as it usually is... We didn't have a mortgage payment, as our mortgage was transferred to a new lender. This was especially helpful because after the month was said and done the only money we had left over was enough for that mortgage payment. This month included a visit from my mother and grandfather, which resulted in a much higher grocery and restaurant bill. Couple this with extra one-time maintenance costs associated with our new home, and we had an expensive month. We'll have to be cognizant of this going forward as our mortgage payment resumes. The good news is that I'll be spending a couple weeks in the field this month so that should keep this months' costs down.

Assets: 25,769.65

Liabilities: -273,412.54

Net Worth (w/ Mortgage): -247,642.89

Net Worth (w/o Mortgage): 12,764.79

Change From Previous Month: +1,253.95

As has been the norm recently, this last month was unusual. Unusually expensive that is. Additional expenses incurred included around $500 in vehicle registration fees, $550 catalytic converter replacement, and around $1,500 in vacation expenses. Even with all these extra costs giving our budget a gut punch, we still managed to put over $700 away into our emergency fund and save 15% of our income for retirement. This is the first month that we started making 401K contributions since March 2018. I hate that we lost so much time in the market, but the good news is that we're putting nearly four times as much toward retirement as we were in 2018. This last month was also our first mortgage payment, which added a small amount to our expenses. Next month will be nice because we won't have a mortgage payment while our loan transfers to another lender. As long as we don't have any major unforseen expenses we should have a solid month.

P.S. Don't mind the error in my color coordination on the graph. I'm sure I'll get around to fixing it sooner than later...

Assets: 24,811.17

Liabilities: -274,165.33

Net Worth (w/ Mortgage): -249,345.16

Net Worth (w/o Mortgage): 11,510.84

Change From Previous Month: +1,728.27

This last month we closed on our first home. The experience as a whole went well and we're enjoying our new home. Along with purchasing our home has come some changes to our financial plan. As you can see on our updated net worth tracker, I've included both our net worth with and without our mortgage included. I believe that our net worth should include our mortgage, but for the sake of consistency, I'm continuing to track our net worth without our morgage so I can accurately compare it to previous months. Even with the multitude of expenses that have come with our first month of home ownership, we still managed to increase our net worth about the average amount. Unfortunately our tracker is going to look upside down for a while until we get back to zero. (You'll have to excuse the backwards red and green color coding while I figure out how to correct it).

Changes to our financial plan include starting 401K contributions again (yeah!), simultaneously building up our emergency fund, and holding off on paying back the student loans (at least until after the Covid-19 mandated forbearance concludes).

Assets: 22,499.39

Liabilities: -12,716.82

Net Worth: +9,782.57

Change From Previous Month: +450.32

Since last month's post, our first offer was rejected. It was the first we'd ever put an offer down for a house and it felt terrible. We loved the house but we had no choice other than to move on and look at house after house after house. Luckily my job at the time allowed me to house hunt during the day and work during the evening. About a week later we found The House. After looking through the home we placed an offer. Long story short, we countered back and forth for a couple days before the seller accepted our offer. Fast forward three weeks and now we're a few short days away from closing on our first home.

While we're very excited to become homeowners, the downside is the immediate effect on our financial plan. Last month was one of our worst for net worth growth. The expenses involved in purchasing a home have been easily manageable for us but they do impact our immediate ability to move forward in our previous financial plan. It's apparent to us that our financial plan will require some flexing to adapt to our impromptu home purchase. That flexing will take some time as we adjust our monthly budget and get used to our new normal.

I'm not too optimistic that next month will look much different in terms of overall growth as we incur the costs of moving. Rather I would be content if our net worth remained steady. Only time will tell.

Assets: 19,252.21

Liabilities: -9,919.96

Net Worth: +9,332.25

Change From Previous Month: +6,828.00

The last month has been weird for us, as it has for most. Luckily there was some good to come from it. We received our Covid-19 stimulus check in the mail and put it in savings to be applied to our student loans this month. Our plan was to have enough money saved by the end of this month to pay off the student loans entirely. This would make us completely debt free! Unfortunately life had different plans waiting for us. We found out this week that the homeowners of the house we're renting intend to move back in on July 1, 2020. That gives us less than two months to find a new place to call home.

We had a discussion, weighed the pros and cons, and decided we'd prefer to purchase our next home rather than rent again. We're both excited and stressed because under normal circumstances we would undergo a rigorous selection process. Here though we're making decisions quickly, but still in a deliberate manner. As of this writing, we've made an offer on our first house. Hopefully it's accepted and we can start the moving process.

Looking back at the last few months, it's lucky that we decided to start saving our extra loan payments to make one lump sum payment. Now we have a significant fund at our disposal to help with moving costs and the costs of buying a home. Hopefully all goes well, we'll see in next month's NWT.

Assets: 15,552.59

Liabilities: -13,048.34

Net Worth: +2,504.25

Change From Previous Month: +1,284.14

This last month has been interesting to say the least. Many people around the world are experiencing the effects of Covid-19. Our state has gone into lockdown, I was pulled out of field training early, Mrs. B and the girls were in Ohio and I had to get authorization from a General Officer to go pick them up and bring them home. The month cost us more than usual in gas and grocery expenses. We easily spent $300 more than usual on groceries alone to stock up our pantry. At the end of the month we had nearly $2,500 leftover. Our net worth would've been significantly higher but we lost a couple thousand dollars in the stock market this last month.

We've recently switched our tactic for paying off our student loans. Rather than pay them off little-by-little each month, we're saving up the money in a money market account until we have enough to pay them all off at the same time. We made this decision about a month before the federal government passed legislation to defer student loan payments and eliminate interest rates in response to many people losing their jobs in response to Covid-19. So while the virus is a terrible scourge on the economy, we at lest are saving money on our student loans where as before we were prepared to spend a few hundred dollars extra due to our new tactic.

Looking forward to the next month or two, we're expecting a $3,400 direct deposit soon from the federl government as a result of the Covid-19 legislation. That money will go toward paying off our student loans a couple months earlier thn originally planned. Additionally, with the recent stay-at-home order, we'll likely save some money as we spend less money going out to eat and visiting spring festivals.

Assets: 14,172.57

Liabilities: -12,952.46

Net Worth: +1,220.11

Change From Previous Month: +2,133.08

We finally made it to a positive net worth! We started our journey exactly two years ago. At the time we were over $30,000 in debt with very little in assets. Since then our debt started going down at a moderate pace before spiking back up to about $41,000 when we unexpectedly had to replace our SUV. Now the SUV is paid off and we have about $11,000 left in student loan debt. We're currently saving the money we have leftover each month in our money market account until we have enought to pay off the student loans all at once! At the rate we're going it should be either the end of July or early August when we become completely debt free. But for now we're celebrating our venture into the positives!

Assets: 13,733.07

Liabilities: -14,646.04

Net Worth: -912.97

Change From Previous Month: +3,983.89

Hey so this month's Net Worth Tracker is coming in a little late because I was waiting for our tax refund to come in (I know, I kind of like doing my taxes so I always do them as soon as possible). Well now that they're in we've taken all of it and shoved it toward our student loans. Looking forward we will more than likely reach a positive net worth by the beginning of March! We had some vehicle maintenance at the very beginning of the month which cost us nearly $400. That alone wouldn't have been enough to push us over that pesky 0, but no problems, we are about a month ahead of schedule when it comes to paying off our debt.

Assets: 13,742.21

Liabilities: -18,639.07

Net Worth: -4,896,86

Change From Previous Month: +1,392.67

This last month was rather unusual. We started the month by paying off the Chevy we bought a year ago. Our goal was to pay it off in one year and we came pretty close. It took us 369 days so I'll take that as a win. We overspent in a lot of categories due to the holidays. We overspent in gas, dining out, miscellaneous expenses (by a lot), as well as a few other things. We understand that our spending will be less controlled during the holiday seasons which is why we save a small amount of money each month to help offset these costs. We applied over $300 of saved money to offset the extra expenses to this month's budget. This allowed us to put nearly $1,600 toward paying off our debts which included paying off the Chevy. Now we own two vehicles free and clear and are working on tackling what's left of our student loans. Currently we are on track to reach a net worth of zero by March, as planned, and will be able to move onto building our emergency fund in September or October 2020.

Assets: 13,672.27

Liabilities: -19,961.80

Net Worth: -6,289.53

Change From Previous Month: +1,696.54

Well this last month wasn't our best, but it wasn't for lack of trying. We had some minor vehicle maintenance that cost us about $160. The same day we took our car out of the shop, wait for it... We hit a deer. So once we were done with the $500 deductible that brings us to a total of $660 that we couldn't put toward our loans. Still nearly $1,700 isn't bad considering we also travelled over a thousand miles to see our family for Thanksgiving. Sadly, as we assumed last month, we did not pay off the car loan this month. But next year the loan will be paid in full!

Assets: 12,712.61

Liabilities: -20,698.68

Net Worth: -7,986.07

Change From Previous Month: +3,511.01

We had another successful month this last October. At the end of the month we were able to put an extra $1,554.54 toward our car loan. This paired with our required loan payments equals $2,203 put toward paying off our debts. That's 34% of our total take home pay meaning we only lived on 66% of our take home pay last month. That 66% is equal to $4,245.58 a month or about $51K a year. Depending on how this next month goes we may be able to pay off our car loan, although it's more likely that we'll pay off the last few hundred dollars in December.

Assets: 12,807.11

Liabilities: -24,304.19

Net Worth: -11,497.08

Change From Previous Month: +945.35

We had a fantastic last month. Although our net worth change from last month is fairly lack luster, when you take into account that we paid off $2,345.16 in debt, we did pretty stellar. Last month was our first month realizing an extra salary increase due to a promotion and we've allocated all of the extra income toward paying off our debts. What is manipulating our net worth in such a way that degrades our progress is that we lost nearly $1,000 in the assets category. About $600 of this was due to us paying for Christmas presents, which we save for throughout the year so that it doesn't come as a surprise. Additionally our investments took a small dip which decreased our assets category. Over all we can't wait to continue paying off large amounts of debt very quickly so we can move on to more exciting ventures.

Assets: 13,772.66

Liabilities: -26,215.09

Net Worth: -12,442.43

Change From Previous Month: +2,573.63

We had a fairly average month as far as debt pay down goes. Unfortunately we had to do some work on both of our vehicles within a week of each other. The total cost was just shy of $700. Even with this we were able to put an extra $300 toward out debt this month, but man would it have been nice to put an extra $1000 down instead. Great news though, I was promoted last week and should see a substantial increase in my pay start halfway through September. If my calculations are correct, my after tax monthly increase will be around $600. This will allow us to put somewhere around $2000 toward our debt each month to include regular monthly payments. We're now in the home stretch of our debt snowball with less than a year until our projected completion date. We've been waiting for this pay bump as we knew it would sharply decrease the amount of time we would need to pay off all of our debt. Needless to say our monthly budget should no longer be too anxiety provoking since we don't plan to make any changes to our lifestyle with this pay increase. We'll simply have a lot more room to maneuver our cash if we need to.

Assets: 11,512.89

Liabilities: -26,528.95

Net Worth: -15,016.06

Change From Previous Month: +1,380.14

Hey all, sorry for the extremely late post. The last three weeks have been a complete whirlwind as I started school again. I had planned to get this posted weeks ago but that obviously didn't happen. Last month went pretty well. On top of our normal loan payments we were able to put an extra $700 or so toward paying off the car. We only owe about $7,000 on it and it should be paid off within the next 4-5 months. We are about a month and a half ahead of our schedule to be debt free and here in another 6-8 weeks we should be receiving a sizeable pay increase from my upcoming promotion. Next months progress won't likely be so spectacular because we just sent both vehicles to the shop this last week. My car needed a new starter and Mrs. B's needed a new power steering pump. Luckily her pump was under warranty so all in all we were out about $650 for both cars. The cost would've been doubled if it weren't for the warranty. Seeing as it is already the end of the month I likely will not be writing a separate post this month. I hope to make my next Net Worth post during the first week of September as usual. This may be the norm while I'm in class depending on how busy they keep us. Till then, best of luck on your endeavors and we'll keep you posted.

Assets: 10,789.24

Liabilities: -33,567.49

Net Worth: -22,778.25

Change from Previous Month: -5,273.85

Assets: 14,524.08

Liabilities: -30,920.28

Net Worth: -16,396.20

Change from Previous Month: +6382.05

Hey so it's been about two months since my last post as it has been super busy around here. To quickly recap, we've moved into a new home in North Carolina, we're nearly done unpacking and getting the home organized, I'm preparing to start school in a couple weeks, our youngest daughter is now 3 months old and is doing great, and now we are finally getting back into a routine. As you can see above our finances have been a bit crazy due to the move but luckily we're through it with no major issues.

As you can see during June our Net Worth dropped considerably but then we rebounded in July. This sharp decrease followed by an even larger increase in Net Worth was due to moving expenses. We had saved up a sizeable amount of cash prior to moving and in the matter of a short 30 days we had completely depleted it. Luckily the military reimburses you for these expenses and in many cases they overcompensate you.

We'll have much more to share in our next post where we'll go into the details of what's occurred these last 60 days.

Assets: 15,280.07

Liabilities: 32,784.47

Net Worth: -17,504.40

Change from Previous Month: +4,335.83

We did much better this last month than we anticipated. Much of this is attributed to not having to spend out of our savings for security deposits and the new nursery. Yet. Sometime during the next month or two we'll have to deplete the money we've saved for moving costs and to furnish the nursery. Luckily much of our moving costs will be recurperated once we receive our reimbursement from the Army and we hopefully receive most of our security deposit back from the rental we live in now.

Liabilities: -35,187.72

Net Worth: -21,840.23

Change from Previous Month: +331.36

Well this last month didn't go as well as we had hoped. We had about $550 extra at the end of March to apply to our debts. In the last few months we've had closer to double that much. Still, I consider us lucky that we had an extra $500 in case there was some minor emergency that sprung up. Just another reason why we do what we do.

I believe our Net Worth would've increased more this last month but much of our savings is being applied to the expected costs of bringing home a newborn. We've been saving up for the last 8 months and as those savings dwindle, so too will our Net Worth (though only artificially). Once we complete our move and settle into our next home we should see our Net Worth start increasing more rapidly. Much of our savings account contains funds that we've socked away specifically for those one-time newborn purchases, such as a crib, and for moving expenses. Though our moving expenses will be reimbursed hopefully by July.

Assets: 13,010.92

Liabilities: 35,182.51

Net Worth: -22,171.59

Change from Previous Month: +3,951.21

As of March 1st we have been tracking our spending and working to pay off our debt for an entire year. It hasn't felt that long and yet I can begin to see it when I start to look at pictures of our oldest daughter. She was less than 7 months when we started and seeing how much she has grown emphasizes the amount of time that has passed. This last month we applied $2,044.46, or 36% of our after tax income, toward paying off our debts. In addition we took $2,500 from our tax return and used it to pay our debts. The remaining $1,600 from our tax return we are saving for upcoming moving expenses. Most of our moving expenses should be reimbursed by July. Whenever we receive our backpay it'll be applied toward our loans.

Last month was the most we have ever saved and paid toward our debts. We had an extra $607 at the end of the month plus we had already added about $80 to our "additional loan payment" category from increasing our tax witholdings. I'm thinking I need to go back to our W4 and increase our witholdings again. $80 a month only equals $960 a year, less than a quarter of what we received on our tax return. I can safely double the increase in our witholdings and still receive a tax refund next year.

I went through the last 12 months of spending in order to do some analysis and find where we can improve our monthly budget. This last year we spent 22.74% of our after tax income on loan payments. I consider this to be our savings rate because once we finish paying off our debt it will all be applied toward building our emergency fund, then investing in retirement, college, and car replacement. During the next year I estimate with salary increases that we'll be able to achieve a savings rate around 29%. I'm taking into account the cost of an additional child during this next year otherwise I'd say we'd be closer to 32%. Alas it will likely take us an additional year to get over the 30% mark.

Here is a more comprehensive breakdown of some of the larger line items and the percentage of our after tax income they accounted for.

Rent: 20.48%

Groceries: 11.02%

Misc: 8.81%

Gas: 4.93%

Vacation: 3.98%

Dining Out: 3.94%

Insurance: 3.41%

We of course had other expenses but the above mentioned ones were the highest percentages with loan payments being the highest. Everything else such as clothing, car repair, phone, cable, and electric were all under 3%. There are a few changes we can make going forward such as increasing the amount of money we set aside for medical expenses. Tricare is very cheap but we'll likely double the $50 a month we put aside now to $100 a month since we spent nearly double what we budgeted. Another difference from last year should be car repairs. Last year we spent over $1,500 on car repairs. In fact I'm positive it was actually well over $2,000, but we had some organizational budgeting issues when we started and it wasn't all accurately categorized. I estimate this next year that our repairs will be less costly since the bulk of last years repair expenses were due to the 2004 Chevy we replaced with a 2013.

As I just mentioned, we had some issues with categorizing our expenses early on. We would simply pour anything that went over budget into the miscellaneous category. Looking back this doesn't make much sense. It makes more sense to just accurately categorize so that when we analyze the data we have an accurate representation of our spending habits. Luckily we fixed our organizational issues early enough that by next January we will be able to start making fully accurate calculations on our spending. As a result I imagine we'll see a decrease in our misc. spending. I don't foresee any substantial increases in any other categories other than groceries and clothing. (Did I mention we're having another kid?) Many categories should actually see a slight decrease in percentage as our income increases, as long as the amount we spend in each category stays relatively the same.

Overall we're very happy with our progress this year. We're in a position that once we pay off our debt and set up a fully funded emergency fund, we'll be able to contribute 15% of our income to our retirement account. We'll also be able to save for Little Miss 1 and 2's college expenses. We're looking forward to our next yearly update in January.

How long hve you been tracking your spending/net worth? What kind of progress have you made during your journey? What changes did you make along the way to streamline your efforts?

Assets: 12,350.71

Liabilities: 38,473.51

Net Worth: -26,122.80

Change from Previous Month: +3,076.11

Notes: We made a few changes this month and a lot of progress toward paying off our debt. We removed the rent column as it's reflected in our cash column each month. We also added the credit cards column because sometimes we carry a larger balance though we always pay off our credit cards each month. The total reduction in liabilities from January (not including the removal of rent) was $1,191.40. Were looking forward to next month because we'll see a drastic reduction in liabilities when we put most of our tax refund toward the car loan.

Assets: 11,666.00

Liabilities: 40,864.91

Net Worth: -29,198.91

Change from Previous Month +1,339.60

Notes: During the last month we took government bonds that Mrs. B owned, cashed them out, and used the funds to start a Roth IRA in her name. We also made our first car payment, but were unable to contribute much more toward the loan due to the holiday season and all of our traveling. We have high hopes for this upcoming month though!

At My Family FI we believe in being as transparent as possible, which is why we will be maintaining a Net Worth Tracker. This tracker will give quantifiable feedback as to our progress toward reaching a $0 net worth, becoming debt-free, and reaching our FI goals. Our tracker lists all of our current assets (green) and liabilities (red). Our total net worth is listed to the far right and is currently -$30,538.51 with $10,571.11 in assets and $41,109.62 in liabilities.